Savings and the pandemic….

Disposable income (income after tax and benefits) is either consumed or saved: Yd = C + S

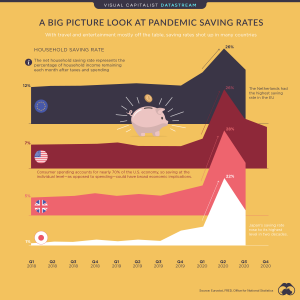

This truth is learned by students early in their macro courses, along with key facts such as that consumption accounts for just over 60% of UK aggregate demand. It’s a truth readily apparent when we look at the movement of the savings ratio (the proportion of disposable income that is saved). As lockdowns have limited our ability to consume, savings ratios around the world have soared, as highlighted in this infographic from www.visualcapitalist.com. All of this seems a world away from the conversation just a couple of years ago, when in the UK we fretted about an unbalanced economy, with demand too dependent on “debt fuelled” consumption. Linked to this were worries about the UK’s relatively low level of investment as a % of GDP (savings provide funds for investment) and whether enough was being squirelled away for the future (in the form of pensions, for example).

In the UK’s case, ONS data shows that the savings ratio peaked at a record high of 25.9% in 2020 Q2, roughly covering the period of the first lockdown. “Saving for a rainy day” (precautionary saving) may also have played a role, as the pandemic reduced job security and heightened fears for the future. Though the data for 2021 Q1, covering another lockdown, are yet to be published, we would expect the savings ratio, which had fallen back to 16.1% by 2020 Q4, to rise again. All of this, of course, despite the fact that interest rates are at historic lows, reducing the reward to saving.

One implication of these figures is that consumers may drive economic recovery in 2021. The Covid-induced recession is not necessarily like recessions that have gone before both in terms of causes and effects. “Pent up demand” draws on the idea that consumers who have saved during lockdown have the potential to spend substantially as the economy opens up, and there have been plenty of signs of this with many outside hospitality venues fully booked as the UK began to open up on April 12th and moderately high levels of footfall on the High Street, although slightly lower than pre-pandemic levels. All of this suggests the potential for a strong bounce-back of the economy later in the year, with the Bank of England forecasting GDP will return to pre-Covid levels in the first quarter of 2022 and Governor Andrew Bailey even acknowledging that there are “upside risks to this forecast”.

Perhaps a good way of summing up the picture is that looking ahead is even more difficult than usual during the pandemic: “Economists have predicted nine out of the last five recoveries” to slightly alter a favourite economist’s joke about recessions. There is so much that could derail the expected recovery, not least the potential for new Covid variants to lead to new lockdowns, as highlighted by Andrew Bailey. Even without this, there is surely higher unemployment yet to come and uncertain consumers will not necessarily spend as much as many commentators suggest. Yet, at the other end of the scale, there is talk of a return of inflation. Could pent up demand and both fiscal and monetary stimulus combine with business closures, and disruption to supply chains from both Covid and Brexit, to see prices rise at a rate not seen for some time? I’m off to sit on my fence……….watch this space!

Footnote, largely based on the idea that once someone has laughed at one of your jokes you should repeat it indefinitely: The UK is running out of both mayonnaise and thousand island dressing – it’s a double dip recession! In reality, the data currently seems to suggest that this is something that the UK may avoid, despite the lockdown of the first few months of 2021.